Welcome to the Jhenesis Mortgage Blog: Your Source for Real Estate Financing Insights

At Jhenesis Mortgage, we understand that navigating the world of real estate financing can be complex, especially for those investing in property. Whether you’re looking for loans for investment properties in Orlando, Atlanta, or beyond, our blog is here to provide you with valuable insights, tips, and resources to make the process smoother.

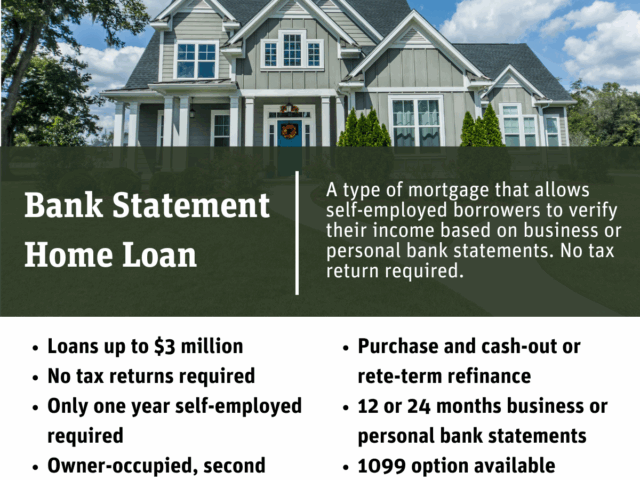

The Entrepreneur’s Complete Guide to Qualifying for a Mortgage Without a Traditional W-2

How to Refinance and Get Out of a Hometap Loan in Florida: A Complete Guide

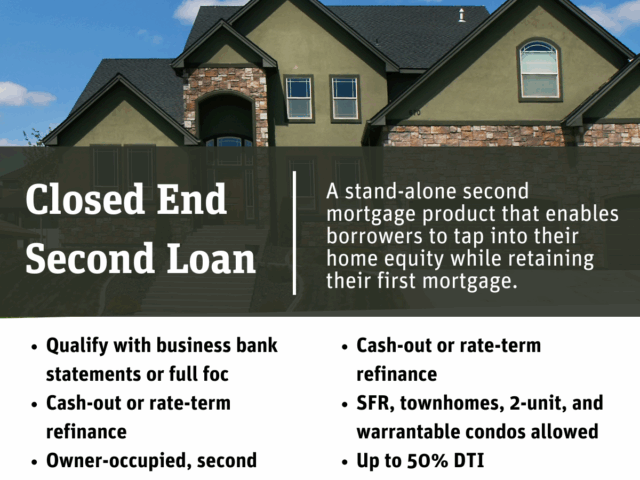

Closed-End Second Mortgage: A Comprehensive Guide to Tapping Into Your Home Equity

Why Is It Hard for Self-Employed to Refinance? (And the Easiest Mortgage Options for Self-Employed Borrowers in Central FL)

Why Non-QM Loans Are Perfect for Realtors and Freelancers

Common Sense Underwriting for Stated Income Loans in Central Florida

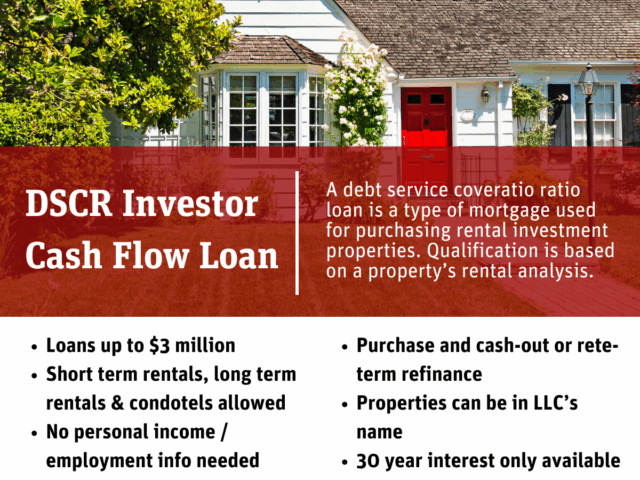

Unlock Rental Property Equity in a Down Market: No-Income-Verification Strategies for Savvy Investors

DSCR Loan Qualifier: Get Approved (No Tax Returns, No Personal Income)

Bank Statement Home Loan: Ultimate Guide for Self-Employed Borrowers

DSCR Investor Cash Flow Loan: Your Guide to Financing Rental Properties

Self-Employed Borrowers: Tap into Home Equity with a Bank Statement HELOC or Closed-End Second Mortgage

Mortgage Refinancing Guide: Navigating the Changing Landscape of Home Financing

Empowering Military Families: Your Guide to VA Loans in Orlando

Decoding Mortgage Credit Scores on 2025: A Guide to Securing Your Dream Home

Bessent says he’ll give Trump Fed Chair options in December

FHFA seeks comment on new strategic plan for GSEs

HUD to lay off 400 employees amid government shutdown

Bank of America dials up outlook slightly after solid Q3

Loandepot accuses West Capital Lending of rampant fraud

The Ultimate Guide for Home Buyers: Navigating Your Path to Homeownership

Financing Options for Real Estate Investors

Unlock Real Estate Opportunities with Investment Property Loans

Investing in real estate in Orlando and Atlanta offers exciting potential for wealth-building. Jhenesis Mortgage provides tailored loans for investment properties in Orlando and Atlanta, helping investors seize opportunities in these thriving markets. Our expert team simplifies the process, ensuring you secure the right financing to grow your portfolio.

Why Choose Investment Property Loans?

Loans for investment properties in Orlando and Atlanta fuel financial growth. These loans differ from traditional mortgages, offering flexible terms for rental properties or fix-and-flips. They empower investors to capitalize on booming real estate markets. With Jhenesis Mortgage, you get clear guidance and competitive rates to maximize returns.

Benefits of Investing in Orlando and Atlanta

Orlando: A Hotspot for Growth

Orlando’s real estate market thrives due to tourism and population growth. Properties near attractions or universities yield strong rental income. Jhenesis Mortgage offers loans tailored for Orlando’s dynamic market, supporting your investment goals.

Atlanta: A Hub for Opportunity

Atlanta’s diverse economy and affordable properties attract investors. From urban rentals to suburban flips, the city offers versatility. Our loans for investment properties in Atlanta provide the flexibility to act fast in this competitive market.

How Jhenesis Mortgage Simplifies Financing

Jhenesis Mortgage streamlines the loan process for investment properties. We offer personalized solutions, quick approvals, and expert advice. Our team understands Orlando and Atlanta’s markets, ensuring you get financing that aligns with your strategy. Apply online at jhenesismortgage.org to start today.

Tips for Securing Investment Property Loans

- Check Your Credit: A strong credit score boosts approval chances.

- Research Properties: Focus on high-demand areas in Orlando and Atlanta.

- Work with Experts: Jhenesis Mortgage guides you through every step.

- Plan Your Budget: Account for property costs and loan terms to ensure profitability.