What Can Your HELOC Do For You?

As a self-employed individual, accessing your home’s equity can provide flexible funding for business growth, debt consolidation, home improvements, or unexpected expenses. Traditional loans often require extensive tax documentation, but options like the bank statement HELOC (Home Equity Line of Credit) or a closed-end second mortgage make it easier. These products are designed specifically for self-employed borrowers, allowing qualification based on business bank statements rather than tax returns.

Whether you’re a freelancer, business owner, or contractor, these home equity solutions can help you leverage your property’s value without the hassle of proving income through conventional means. Conditions apply, and eligibility varies—contact a mortgage professional to see if you qualify.

What Is a Bank Statement HELOC?

A bank statement HELOC is a revolving line of credit secured by your home’s equity, tailored for self-employed borrowers. Instead of relying on tax returns, lenders use your business or personal bank statements (typically 12-24 months) to verify income. This non-QM (non-qualified mortgage) product offers flexibility, with no restrictions on fund usage.

Key features include:

- Revolving credit: Borrow as needed, repay, and borrow again.

- Variable interest rates, often lower than credit cards or personal loans.

- Draw period (usually 10 years) followed by repayment (15-25 years).

- Available in first or second lien positions.

This option is ideal if your tax returns don’t fully reflect your income due to deductions and write-offs common among self-employed individuals.

Benefits for Self-Employed Borrowers

Self-employed professionals often face challenges with fluctuating income, making traditional loans harder to obtain. A bank statement HELOC or closed-end second mortgage addresses this by focusing on cash flow shown in bank statements.

Advantages include:

- No Tax Returns Required: Qualify using bank statements or 1099s, bypassing low taxable income from business expenses.

- Flexible Use of Funds: Use for business investments, renovations, education, or emergencies—no restrictions.

- Longer Terms: 15-25 year repayment periods for manageable payments.

- Potential Tax Deductions: Interest may be deductible if used for home improvements (consult a tax advisor).

- Build Business Credit: Timely payments can improve your financial profile.

These products can advance your business by providing lower-interest funding compared to unsecured loans.

General Qualifications and Eligibility

While requirements vary by lender, here are common qualifications for a bank statement HELOC or closed-end second mortgage:

- Minimum Credit Score: 660 or higher.

- Self-Employment Duration: At least 2 years in the same business.

- Mortgage Status: Current on your existing mortgage payments.

- Bank Account History: No non-sufficient funds (NSF) charges in recent statements.

- Income Verification: Qualify using 12-24 months of business bank statements; no tax returns needed.

- Debt-to-Income Ratio (DTI): Typically under 40-45%, calculated from bank deposits.

- Home Equity: Sufficient equity (often 15-20% after borrowing).

- Citizenship: Eligible for U.S. citizens and permanent resident aliens.

- Loan Terms: 15-25 years.

Lenders assess risk based on your overall financial stability, including credit history and home value. Self-employed borrowers may face slightly higher rates due to perceived income variability. Conditions apply—always verify with a broker.

HELOC vs. Closed-End Second Mortgage: Which Is Right for You?

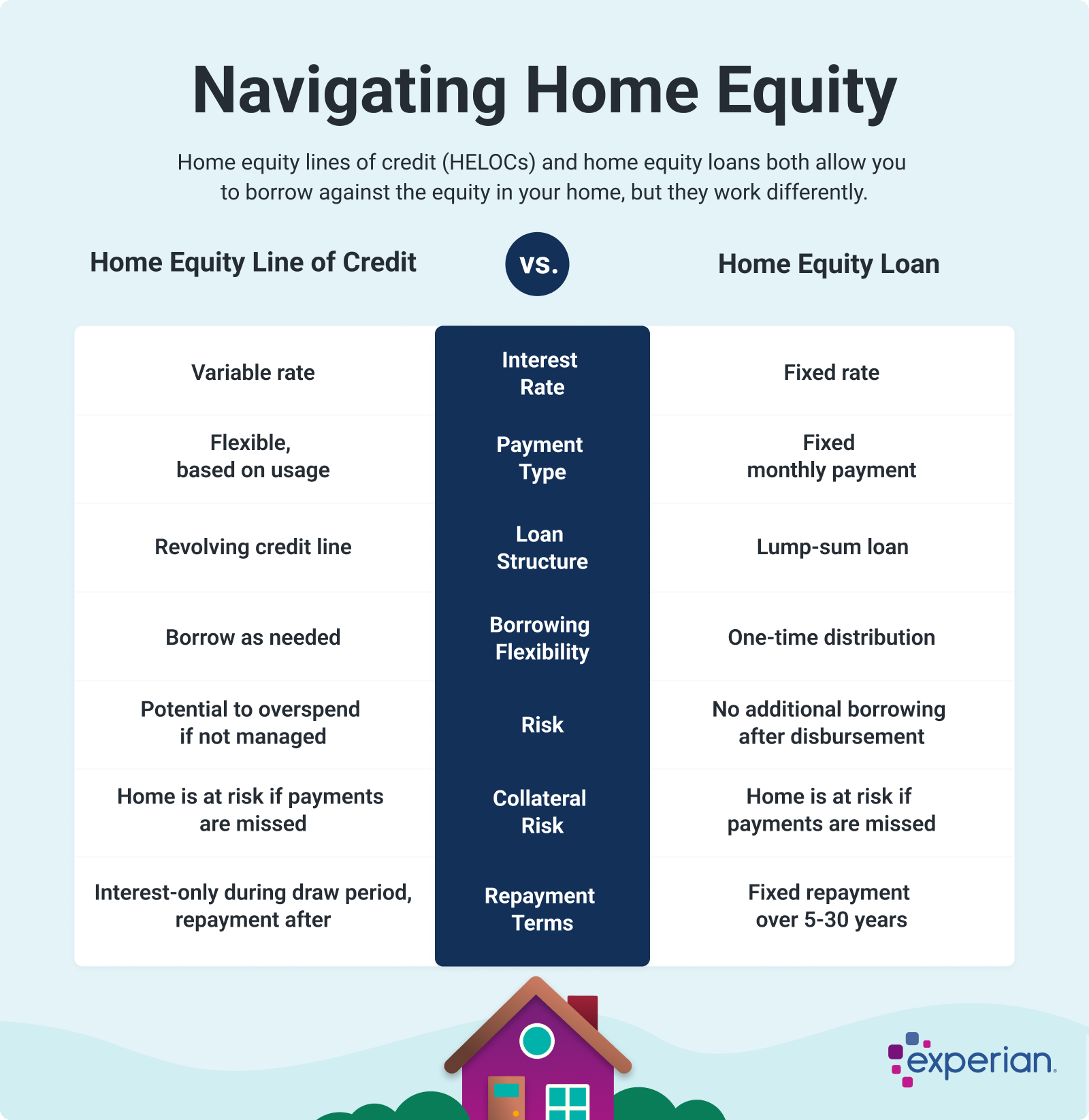

HELOC vs. Home Equity Loan Comparison

Both options allow self-employed borrowers to access equity, but they differ in structure:

| Feature | HELOC (Home Equity Line of Credit) | Closed-End Second Mortgage (Home Equity Loan) |

|---|---|---|

| Structure | Revolving line; borrow as needed | Lump-sum loan; fixed amount disbursed upfront |

| Interest Rate | Variable, based on market | Fixed, predictable payments |

| Repayment | Interest-only during draw period; principal + interest after | Fixed monthly payments over term |

| Flexibility | High—reuse credit as you repay | Low—one-time borrow |

| Best For | Ongoing needs like business expenses | Specific, one-time costs like debt consolidation |

| Risks | Rate fluctuations; potential overspending | Higher initial payments; no additional borrowing |

Choose a HELOC for flexibility or a closed-end second if you prefer stability.

Eligible Properties: Primary, Secondary, and Investment

These home equity products aren’t limited to your main residence. You can apply them to:

- Primary Residences: Owner-occupied homes where you live.

- Secondary Homes: Vacation or second properties.

- Investment Properties: Rental or non-owner-occupied real estate.

This versatility makes them appealing for real estate investors or those with multiple properties. Note: Investment properties may have stricter LTV (loan-to-value) limits.

How Much Home Equity Could You Borrow?

How Much Can You Borrow?

Lenders typically allow borrowing up to 80-90% of your home’s value minus outstanding mortgages. For example:

- Home value: $500,000

- Outstanding mortgage: $300,000

- Max borrow: ($500,000 x 85%) – $300,000 = $125,000

Actual amounts depend on your qualifications and lender policies.

Frequently Asked Questions (FAQ)

Based on top search queries for self-employed HELOC and bank statement loans, here are answers to common questions:

Can self-employed individuals get a HELOC without tax returns?

Yes, through bank statement programs. Lenders use 12-24 months of deposits to verify income instead of tax documents.

What is the minimum credit score for a self-employed home equity loan?

Most lenders require at least 660, but higher scores (700+) can secure better rates.

How long do I need to be self-employed to qualify?

Typically at least 2 years, with consistent bank statements showing stable income.

What documents are needed for a bank statement HELOC?

Business bank statements (12-24 months), proof of self-employment, credit report, and property appraisal. No W-2s or tax returns required.

Are there higher interest rates for self-employed borrowers?

Possibly, due to income fluctuation risks, but rates are still lower than unsecured loans. Shop around for the best terms.

Can I use a HELOC on an investment property?

Yes, for primary, secondary, or investment properties, as long as you meet equity and qualification criteria.

What are the pros and cons of a HELOC for self-employed?

Pros: Flexible access, no fund restrictions, easier qualification. Cons: Variable rates, risk of overborrowing, potential higher fees.

How does a closed-end second mortgage differ from a HELOC?

A closed-end provides a fixed lump sum with stable payments, while a HELOC offers revolving credit.

Is interest on a home equity loan tax-deductible?

Often yes, if used for home-related purposes, but consult a tax professional.

What if I have fluctuating income as a self-employed borrower?

Bank statements average deposits to show consistent cash flow, helping mitigate this issue.

Ready to Unlock Your Home Equity? Contact Stacy Ann Stephens Today!

Don’t let traditional income verification hold you back. As a self-employed borrower, you deserve flexible financing options. Reach out to Stacy Ann Stephens, an experienced Mortgage Broker at Jhenesis Mortgage, to discuss if a bank statement HELOC or closed-end second mortgage is right for you.

- Cell: 203-910-5549

- Office: 407-630-9766

- Email: stacyann@jhenesismortgage.com

- Website: https://jhenesismortgage.com

- NMLS#: 1933745

Schedule your appointment now and take the first step toward financial freedom. Conditions apply—let’s see if you qualify!