Demystifying Credit Scores for Mortgages in 2025: Your Path to Homeownership

The dream of homeownership remains a cornerstone of the American ideal, representing stability, investment, and a place to build a future. As we look towards 2025, the journey to securing a mortgage continues to evolve, with one factor consistently standing out as paramount: your credit score. Far from being an abstract number, your credit score is a powerful financial fingerprint that profoundly influences your eligibility for a home loan, the interest rate you’ll pay, and ultimately, the overall cost of your mortgage.

For many prospective homebuyers, the world of credit scores can seem opaque and daunting. What is a “good” credit score for a mortgage? How do lenders assess this crucial metric? And what steps can you take now to ensure your credit profile is robust enough to secure the best possible terms in 2025? This comprehensive guide will demystify the intricate relationship between your credit score and mortgage approval, providing actionable insights, expert advice, and a clear roadmap to prepare you for a successful homebuying journey. We’ll explore the components of your credit score, delve into lender expectations for various loan types, and equip you with the strategies needed to optimize your financial health, ensuring your path to homeownership in 2025 is as smooth and affordable as possible.

Understanding the Cornerstone: What Exactly is a Credit Score?

Before diving into the specifics of mortgages, it’s essential to grasp the fundamental concept of a credit score. At its core, a credit score is a three-digit number designed to predict the likelihood that you will repay borrowed money on time. It’s a quick, standardized way for lenders to assess your creditworthiness and the risk associated with lending to you. This number is derived from the information contained within your credit reports, which document your borrowing and repayment history.

In the context of mortgages, your credit score acts as a crucial indicator of your financial responsibility. A higher score signals to lenders that you are a reliable borrower, making you a more attractive candidate for favorable loan terms. Conversely, a lower score suggests a higher risk, which can lead to higher interest rates, stricter loan conditions, or even outright denial of a mortgage application. Understanding how your credit score is calculated and what factors influence it is the first critical step toward preparing for homeownership in 2025.

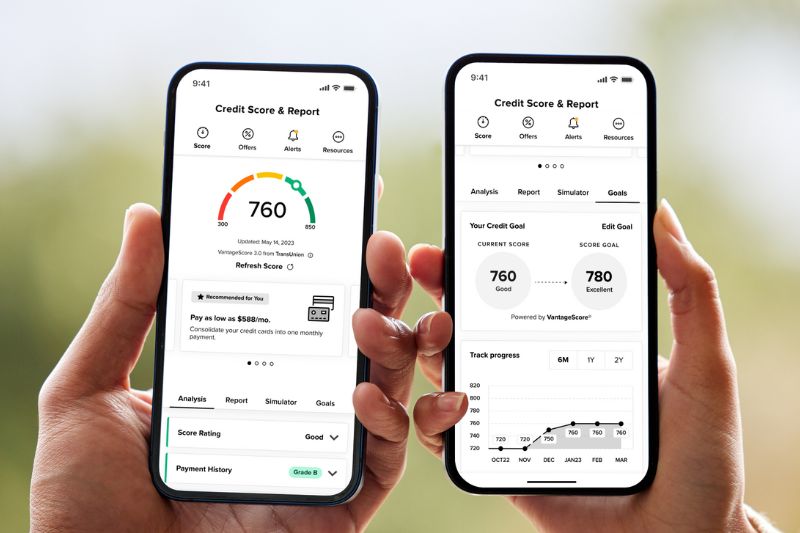

The Major Players: FICO vs. VantageScore

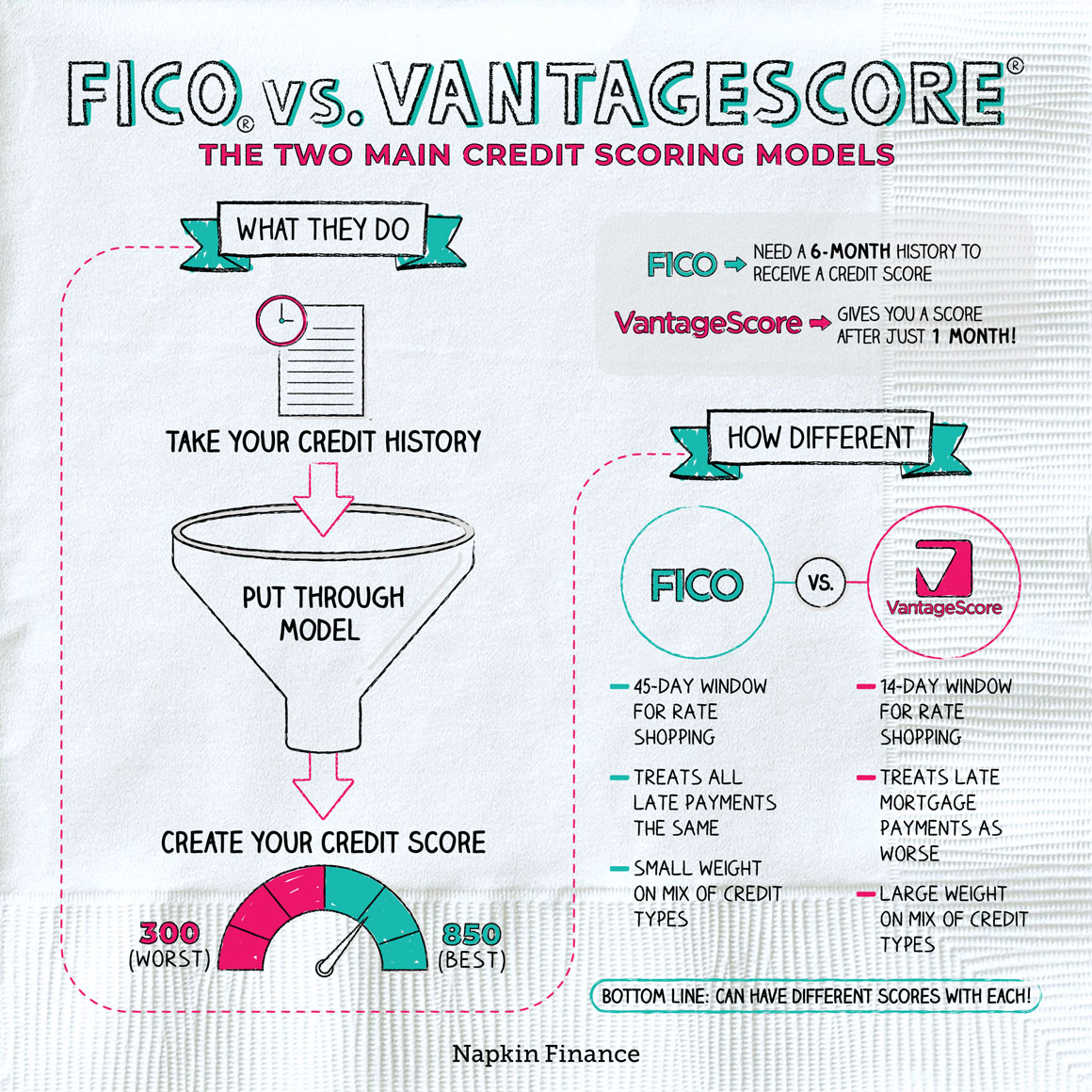

When discussing credit scores, two primary scoring models dominate the landscape: FICO and VantageScore. While both serve the same purpose, they employ slightly different methodologies and scales.

-

-

- FICO Score: Developed by the Fair Isaac Corporation, FICO scores are the most widely used credit scores by lenders, especially in the mortgage industry. There are various versions of the FICO score (e.g., FICO 8, FICO 9, FICO Auto Score, FICO Bankcard Score), but for mortgages, lenders often use specific FICO versions like FICO Score 2, 4, and 5, which are tailored for mortgage lending. FICO scores typically range from 300 to 850.

- VantageScore: Created by the three major credit bureaus (Experian, Equifax, and TransUnion) in collaboration, VantageScore is another prominent model. Its most common version, VantageScore 3.0, also ranges from 300 to 850. While gaining traction, VantageScore is less frequently the primary score used by mortgage lenders compared to FICO.

-

For mortgage applications, lenders typically pull FICO scores from all three major credit bureaus. They often use the middle score among the three to make their lending decisions. If there are two applicants, they will typically use the lower of the two middle scores. This practice underscores the importance of maintaining a strong credit profile across all bureaus.

Decoding Your Credit Report: The Foundation of Your Score

Your credit score doesn’t appear out of thin air; it’s a mathematical representation of the data in your credit reports. These reports are detailed summaries of your credit history, compiled by the three major credit bureaus: Experian, Equifax, and TransUnion. Each report contains several key categories of information that directly impact your score:

-

-

- Payment History (Approx. 35% of FICO Score): This is the most significant factor. It details whether you’ve paid your bills on time, every time. Late payments, bankruptcies, foreclosures, and collections accounts will severely damage your score.

- Amounts Owed / Credit Utilization (Approx. 30% of FICO Score): This refers to how much credit you’re using compared to your total available credit. A high credit utilization ratio (e.g., using 70% of your available credit) indicates higher risk and can significantly lower your score. Keeping this ratio low is crucial.

- Length of Credit History (Approx. 15% of FICO Score): Lenders prefer to see a long history of responsible credit use. The older your accounts, the better, as it provides more data on your payment patterns.

- New Credit (Approx. 10% of FICO Score): Opening multiple new credit accounts in a short period can be seen as risky behavior. Each “hard inquiry” (when a lender checks your credit for a loan application) can cause a small, temporary dip in your score.

- Credit Mix (Approx. 10% of FICO Score): Having a healthy mix of different types of credit (e.g., revolving credit like credit cards and installment credit like car loans or student loans) can positively impact your score, demonstrating your ability to manage various forms of debt.

-

It is absolutely critical to regularly review your credit reports for accuracy. Errors, such as accounts you didn’t open or payments incorrectly marked as late, can unfairly depress your score. You are entitled to a free copy of your credit report from each of the three major bureaus annually via AnnualCreditReport.com. Make this a routine part of your financial health check-up.

The Mortgage Landscape in 2025: How Credit Scores Fit In

As we look ahead to 2025, the mortgage market will continue to be influenced by economic factors, regulatory changes, and lender risk appetites. While specific forecasts can shift, the fundamental role of your credit score will remain unwavering. Lenders use your credit score as a primary tool to assess the likelihood of you repaying your mortgage, directly impacting their decision-making process.

In 2025, as in previous years, lenders will be acutely focused on mitigating risk. A strong credit score signals financial stability and responsible borrowing behavior, making you a more attractive borrower. Conversely, a low credit score implies a higher risk of default, which lenders will compensate for by offering less favorable terms or denying the loan altogether. Understanding the general requirements for various loan types will be crucial for any prospective homeowner.

Minimum Credit Score Requirements by Loan Type

The “minimum” credit score for a mortgage isn’t a single, universally applied number. It varies significantly depending on the type of loan you pursue and the specific lender’s criteria. However, general guidelines exist:

-

-

- Conventional Loans (Fannie Mae & Freddie Mac): These are the most common types of mortgages, not backed by a government agency. For conventional loans, you’ll generally need a minimum FICO score of 620 to 640. However, to qualify for the best interest rates and terms, a score of 740 or higher is often recommended. Lower scores may require larger down payments or result in higher interest rates.

-

Understanding Conventional Loans: Your Guide to Fannie Mae and Freddie Mac

-

-

- FHA Loans (Federal Housing Administration): Designed to help first-time homebuyers and those with less-than-perfect credit, FHA loans have more flexible credit requirements. You can potentially qualify with a FICO score as low as 500-579 (with a 10% down payment) or 580 and above (with a 3.5% down payment). While these scores are lower, lenders may still have their own overlays, often preferring scores closer to 620-640 for FHA loans.

-

FHA Loans Explained: A Pathway for First-Time Homebuyers

-

-

- VA Loans (Department of Veterans Affairs): Exclusively for eligible service members, veterans, and surviving spouses, VA loans are a tremendous benefit as they often require no down payment and no private mortgage insurance. The VA itself doesn’t set a minimum credit score, but most lenders offering VA loans will look for a FICO score of at least 620.

-

VA Loans: Benefits and Eligibility for Military Families

-

- USDA Loans (United States Department of Agriculture): These loans are for low-to-moderate-income individuals purchasing homes in eligible rural areas. While the USDA doesn’t have a strict minimum score, lenders typically seek a FICO score of 640 or higher for streamlined processing. Scores below this may require manual underwriting, which involves a more thorough review of your financial history.

- Jumbo Loans: These are non-conforming loans that exceed the conventional loan limits set by Fannie Mae and Freddie Mac. Because they represent a higher lending risk, jumbo loans typically require excellent credit, often a FICO score of 700-740 or higher, substantial down payments, and very low debt-to-income ratios.