If you’re self-employed and dreaming of homeownership, traditional mortgages can feel out of reach due to strict income verification rules. Enter the bank statement home loan—a flexible option designed specifically for entrepreneurs, freelancers, and business owners. This type of mortgage lets you qualify based on your bank statements rather than tax returns or W-2s, making it easier to prove your income through real cash flow.

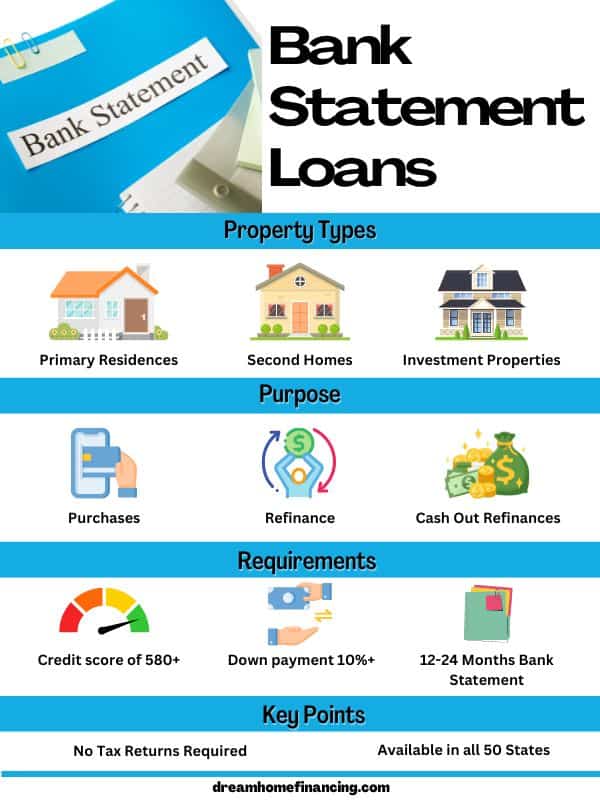

An infographic illustrating key features of bank statement loans, including property types, purposes, and requirements.

In this comprehensive guide, we’ll cover everything you need to know about bank statement home loans, including how they work, general qualifications, benefits, and common FAQs. Whether you’re purchasing a primary residence, second home, or investment property, this loan could be your key to unlocking home financing. Disclosure: Conditions apply. Contact us to see if you qualify.

What Is a Bank Statement Home Loan?

A bank statement home loan is a non-qualified mortgage (non-QM) that allows self-employed borrowers to verify their income using personal or business bank statements instead of traditional documents like tax returns, pay stubs, or W-2 forms. It’s ideal for those who write off significant business expenses on their taxes, which can make their reported income appear lower than their actual cash flow.

Inspired by innovative lending solutions, these loans can fund up to $3 million for purchases, cash-out refinances, or rate-term refinances. Key features often include:

- No tax returns required.

- Only one year of self-employment needed in some cases.

- Options for owner-occupied homes, second homes, or investment properties.

- 12 or 24 months of bank statements to demonstrate consistent deposits.

- 1099 income options available.

- Interest-only payments for up to 40 years in select programs.

Unlike conventional loans, lenders calculate your qualifying income by averaging deposits over the provided statements, often applying an expense factor based on your business type.

Illustration of a self-employed borrower reviewing mortgage options without needing tax returns.

Benefits of Bank Statement Home Loans

Bank statement loans offer several advantages for non-traditional earners:

- Flexible Income Verification: Use bank statements to show your true earning potential, bypassing tax deductions that reduce reported income.

- No Need for Tax Returns: Perfect if your tax filings don’t reflect your actual cash flow due to write-offs.

- Higher Loan Amounts: Access loans up to $3 million or more, depending on the lender.

- Property Versatility: Suitable for primary residences, vacation homes, or rental properties.

- Faster Approval for Qualified Borrowers: With fewer documents, the process can be streamlined if your statements are strong.

- Interest-Only Options: Some programs allow interest-only payments for extended periods, lowering monthly costs initially.

However, these loans often come with higher interest rates and down payment requirements compared to conventional mortgages, reflecting the added risk for lenders.

General Qualifications for a Bank Statement Home Loan

While requirements vary by lender, here are the typical qualifications based on industry standards:

- Self-Employment History: At least 1-2 years of self-employment, verified through business licenses or CPA letters.

- Bank Statements: 12-24 months of personal or business statements showing consistent deposits. Lenders average these to determine income, often deducting an expense factor (e.g., 50% for certain businesses).

- Credit Score: Minimum of 620-680, though higher scores unlock better rates.

- Down Payment: 10-20% or more, depending on the property type and your credit.

- Debt-to-Income (DTI) Ratio: Typically under 50%, calculated using the adjusted income from statements.

- Reserves: 3-12 months of mortgage payments in liquid assets to show financial stability.

- Loan Amount: Minimums often start at $150,000, with maximums up to $4 million.

- Property Types: Owner-occupied, second homes, or investments; some lenders allow condos or multi-unit properties.

Large or irregular deposits may require explanation, and shared accounts could complicate verification if not solely business-related. Always check with a mortgage professional for personalized assessment.

How to Apply for a Bank Statement Home Loan

- Gather Documents: Collect 12-24 months of bank statements, proof of self-employment (e.g., business license), and details on your business expenses.

- Check Your Credit: Review and improve your score if needed.

- Shop Lenders: Compare non-QM lenders specializing in bank statement programs for the best rates.

- Get Pre-Approved: Submit statements for an initial income calculation.

- Submit Application: Provide additional info like asset statements and property details.

- Underwriting and Closing: Expect a thorough review, but approval can happen in weeks.

Step-by-step infographic on how to secure a self-employed mortgage loan.

FAQ: Common Questions About Bank Statement Home Loans

What is a bank statement home loan?

A bank statement home loan is a mortgage that uses your bank statements to verify income instead of tax returns or W-2s, ideal for self-employed individuals.

Who qualifies for a bank statement loan?

Primarily self-employed borrowers or those with non-traditional income. You need at least 1-2 years in business, good credit, and consistent bank deposits.

How many months of bank statements do I need?

Most lenders require 12-24 months, though some strong applicants might qualify with fewer (e.g., 3 months in rare cases).

What credit score is needed for a bank statement loan?

Typically 620 or higher, with more flexible requirements than conventional loans.

Can I use a bank statement loan for an investment property?

Yes, many programs allow purchases of investment properties, second homes, or primary residences.

Are interest rates higher for bank statement loans?

Yes, rates are often 0.5-1% higher than conventional mortgages due to the non-QM nature, but they can be fixed or adjustable.

Can I use personal bank statements for a business loan?

Yes, if your business income is deposited there, but it may require additional verification if the account is shared.

What if I have large deposits on my statements?

You’ll need to explain and source them; unexplained deposits could affect approval.

Is a bank statement loan a non-QM loan?

Yes, it’s considered non-qualified, meaning it doesn’t follow standard QM rules, which can make it riskier but more accessible.

What are the pros and cons of bank statement loans?

Pros: Flexible verification, no tax returns, higher loan limits. Cons: Higher rates, larger down payments, stricter underwriting on deposits.

Ready to Explore Your Bank Statement Home Loan Options?

Don’t let traditional lending barriers stop you from achieving homeownership. With a bank statement home loan, your cash flow takes center stage. Conditions apply. Contact us to see if you qualify.

For personalized guidance, reach out to Stacy Ann Stephens, an experienced Mortgage Broker at Jhenesis Mortgage. She’ll help you navigate the process and find the best fit for your needs.

Stacy Ann Stephens Mortgage Broker Jhenesis Mortgage Cell: 203-910-5549 Office: 407-630-9766 NMLS#: 1933745 stacyann@jhenesismortgage.com https://jhenesismortgage.com

SCHEDULE APPOINTMENT today and take the first step toward your dream home—call or email Stacy now for a free consultation!